|

Chris Bell | 'The man on top of the mountain didn't fall there.' |

| - Vince Lombardi |

|

Chris Bell | 'The man on top of the mountain didn't fall there.' |

| - Vince Lombardi |

SNHU - MBA-520 - Accounting and Financial Analysis

Written by: Chris Bell - March, 2017

Citi's 2015 Corporate Finance Priorities state that they want to "drive corporate growth in divergent markets (Citibank, 2015)" which will affect accounting procedures and business decisions by further increasing their revenue beyond US markets. Most countries have lower tax rates than the US, so US companies that conduct business abroad will reinvest profits in that country to avoid a repatriation tax when the money is brought back to the US. Therefore, Citi can continue their corporate growth in divergent markets by reinvesting profits within the same country which will increase the bottom line and compound into the future. It wouldn't make sense to lower net income by bringing money back to the US, pay the balance of 39% in taxes that haven't been paid abroad, and try to reinvest less money here. In fact, if they have a solid investment plan for the US that needs the money sitting in banks abroad, they could get a loan for the money they need at less than 4% instead paying taxes.

I believe Citi is more efficiency oriented even though all companies work on growth opportunities, because they have strong environmental and citizenship plans that focus on "combating climate change, championing sustainable cities and engaging people and communities. (Citigroup, 2015)" Citi has been in business for more than 200 years and has a long term approach to risk management, along with a department of individuals working on internal and external opportunities for risk mitigation.

Citi already capitalizes on non-financial factors such as market share, reputation, human resources, physical facilities and patents with their environmental strategy, philanthropic focus, and their citizenship priorities program explained in their 2015 Global Citizenship Report. They are also incorporating these plans globally along with volunteer programs set up through Citi. The focus on human resources and reputation as, a company that cares about everyone and the environment, is welcoming to customers of all nationalities and breeds.

The most significant internal risks associated with Citi's financial performance are making sure the key people from 2008 don't repeat any of the same mistakes from the past, such as "...tripling leverage limits for high yield bridge loans and mezzanine exposure to $20bn 'despite a known degradation of underwriting standards in this business' in 2007. (Alloway, 2011)" I found only one person on Citi's board of directors, Judith Rodin, that was Director of Citigroup since 2004 and lasted through the financial crisis, while the rest of the 17 board members began at Citi sometime after 2008. However, most investment bankers and highly qualified individuals were somewhere in the industry long before the crash and remain there now, so the BODs need to be careful not to repeat history even when competition gets fierce.

Technology is another internal threat to Citi. They are a prime target for hackers all over the world due to the amount of data they hold in their technological systems. Identities have been known to be stolen with a small amount of data, never mind everything within Citi's database, so their security teams and encryptions need to be top of the line. IT security systems need to be monitored around the clock because unlike bank robbers you rarely see these crooks coming.

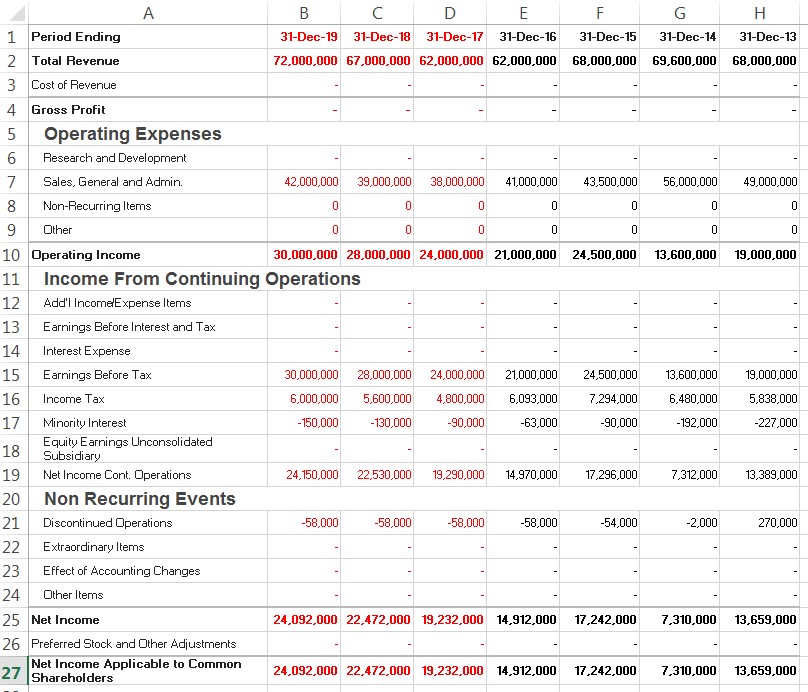

Citi's likely consolidated financial performance for each of the next three years looks positive (Appendix 1) because they have proven that they have a strong grasp on SGA costs over the past 3 years which I believe will increase operating income into the future as revenues grow. There have also been numerous discussions about lowering corporate taxes from 39% to 20% which will change Citi's average global tax rate of 30% in the last 3 years to 20% over the next 3 years. That would increase Citi's net income by $2.4 Billion in 2017 or $8.2 Billion over the next 3 (forecasted) years. Finally, according to the Senior Economics Reporter of Market Watch, Greg Robb, the federal reserve has been discussing and increase in interest rates which will increase revenue and net profit "The Federal Reserve on Wednesday [Dec. 14, 2016] raised a key U.S. interest rate for the first time in a year and signaled a more aggressive approach in 2017, when incoming president Donald Trump plans a full-throttle strategy to jack up the American economy. (Robb, 2016)" I incorporated 3 major changes on the income statement which is a mix between an educated guess, a best-case scenario and certain political changes coming to fruition: Revenue, SGA costs and Income Taxes Paid, which rapidly increase net profit by an annual total of $10 Billion by 2019.

Based on the potential success factors and risks identified, my projections for a best-case scenario are mentioned above, but could be increased in terms of the literal term "best-case". However, my projections nearly reach a 50% increase in net profit within 3 years so I'll leave that as the best case scenario. The worst-case scenario would be the exact opposite which would mean Citi would not have a good handle on SGA costs, interest rates would decrease and the new president, Donald Trump, would fail miserably with his tax reform plan and at making America great again. That would mean that revenues would continue to slightly decline as they have in the past 3 years, SGA costs would increase -forcing operating income to decrease-, and taxes would continue to average 30% which wouldn't have an effect on the bottom line. As sales decrease it can be hard to keep up with lowering expenses, especially SGA expenses, which means in the worst case scenario Citi's net income could drop by 50% over the next 3 years. However, I strongly believe that at least one of the 3 projections will occur and effect Citi's income statement in a positive manner.

It's important to mention and discuss my assumptions, forecasting methodology and information gaps within my projections which I believe relate strongly towards new governmental policies and changes such as tax reform, interest rates and President Donald Trump. However, those issues have nothing to do with SGA expenses and how to effectively manage then in comparison to revenue. My best case projections are aggressive but possible and appropriate considering all of the changes to the economy, to the point that it could be considered a transitional point in history, since the 2008-crisis was mostly blamed on the financial industry. It can be easy to turn your eye away from negative projections too quickly without efficiently mitigating any chances of the worst case from happening, so Citi should be aware of these possibilities and prepare for the worst without assuming a new president will somehow double Citi's net income without any hard work or plans to reach those goals.

I didn't arbitrarily assume that Citi's revenue will increase, I put substance behind the fact that the economy has signs of transitioning and interest rates could improve revenue if the Federal Reserve decides to increase rates. I lowered the percentage of SGA expenses over the next 3 years since Citi has proven to do the same in their last 4 years already. The biggest assumption, hopeful thought and change to the bottom line was the major decrease in corporate taxes from 39% to 20%, or in Citi's average case, 30% to 20%. It's a major change that all companies will see, not just Citi, so it can't quite be labeled as a competitive advantage. However, Citi competes with Goldman Sachs, one of the 30 companies in the DJIA, and Citi has had twice as much net income over the past 4 years, so Citi will see a higher adjustment in net income dollar-for-dollar, just not as a percentage. It will be interesting to review and compare the cash flow statements of comparable companies in 4 years if tax reform does happen, in order to see how they each decide to use the new cash as income producing assets for their shareholders.

References:Alloway, T. (2011). A Risk Management Review of Citi. Retrieved from:https://ftalphaville.ft.com/2011/02/24/497481/a-risk-management-review-of-citi-revealed/ Citibank (2015). Citi Corporate Finance Priorities in 2015. Retrieved from: http://www.citibank.com/transactionservices/home/sa/b2/eSource_academy/docs/corporate_finance_priorities.pdf Citigroup (2015). Strategic Priorities. Retrieved from: http://www.citigroup.com/citi/environment/strategicpriorities.htm Robb, G. (December 2016). Fed raises interest rates and adds another hike to its 2017 forecast. Retrieved from: http://www.marketwatch.com/story/fed-raises-interest-rates-and-adds-another-hike-to-its-2017-forecast-2016-12-14 |

1.